Cant Afford To Pay Irs

Q Tbn 3aand9gcrhrgjwso8hvp Uphopsvzmkgid6qoaqtvqvq Usqp Cau

Can T Pay Taxes 7 Realistic Options If You Are Unable To Pay Irs Taxes

Blackfin Irs Solutions How To Become Bullet Proof When You Can T Afford To Pay The Irs

The Irs Won T Call You They Hired Debt Collectors To Do That For Them

Here S What Happens If You File Taxes Late Or Pay Your Taxes Late Huffpost Life

Know What To Expect During The Irs Collections Process Debt Com

If you cannot pay off your balance within 1 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person.

Cant afford to pay irs. That is, you can’t pay 18's taxes via installment and then request to pay 19's taxes via. Fees for IRS installment plans If you can pay off your balance within 1 days, it won't cost you anything to set up an installment plan. No racist, discriminatory, vulgar or threatening language will be tolerated.

Options could include reducing the monthly payment to reflect your current financial condition. The realization that you can’t afford to pay your taxes can be stressful and burdensome, but you don’t have to worry about it. If you can’t afford to pay your tax bill, you might qualify for an “Offer in Compromise.” Advertisement GOBankingRates points out that, in some cases, you can actually settle a smaller amount or set up a repayment plan with the IRS.

You also should file a tax return even if you are unable to pay so you can avoid additional penalties. You can go on the IRS website and apply for a payment plan. A failure to file taxes and pay what you on on time could result in late penalties and interest of 25% or more.

Plus, if you can show cause for your late payment, the charges could be waived. Even if you can’t afford to pay your balance, it’s important to communicate with the state. Face the issue head on so you can get the mess cleaned up, then make sure you’re never in that position again.

If you owe more in taxes than you can afford to pay, you have better options than simply not paying. There's also a penalty for failure to file a tax return, so you should file timely even if you can't pay your balance in full. It’s that dreaded time of year again.

With this arrangement, the state agrees to settle your tax debt for less than the full amount you owe. What do you do?. In many cases, there are steps we can take to help ease the burden.

You’re not alone, and your plight is not unusual. If you can’t pay your estimated quarterly taxes, don’t make the mistake of not filing at all or ignoring your situation. Plus, the Failure to Pay penalty the IRS charges those who don’t pay is reduced by half if you’re enrolled in a plan.

If the IRS returns your offer. If you owe more than $50,000 or need more than six years to pay,. The government is sensitive to the issue of whether you can afford to pay, so they’re willing to work with you a little bit.

He says if you owe money, but you can’t afford to pay by July 15 – don’t panic. If you owe. Here are some steps you can take to ensure that you don’t land on the wrong side of the IRS — and while we can’t assure you it’s easy, we can guarantee you it’s not impossible.

There are ways to solve things and make things right. 3 Tax Mistakes You Can't Afford to Make Avoid these mistakes so you don't end up owing the IRS more than the minimum you're required to pay. The IRS offers short-term repayment plans that give you 1 days to pay your tax bill.

The penalty for not paying your taxes depends on the total tax you owe. Contact the IRS as soon as you know you can’t pay, before the deadline if possible. You can’t solve it by not filing or by hiding from the IRS.

And what happens if you can’t afford to pay your taxes?. If you can prove financial hardship – meaning you can’t pay the IRS right now – the IRS won’t ask you to pay until your circumstances have improved. If you're not able to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty.

So, if you can’t pay your taxes,you might not have to pay until you’re able to. We generally don't recommend credit card payments, because the fees. To help people who cannot afford to pay their taxes, the IRS and many states offer different resolution options.

What If I Can’t Afford to Pay Back the IRS. The IRS assesses two types of tax penalties:. To qualify for many of these options, you must apply and meet specific criteria.

But even if you can’t pay a tax bill on time, don’t neglect to file your return by the deadline. Homeowners can also see if they can do a property tax appeal. You also should contact the IRS to discuss your payment options at 800-9-1040.

There are criminal penalties if the Internal Revenue Service can prove (the burden of proof is on them) that you intentionally didn’t pay your taxes, but we’ll assume. File Your Return on Time. If the IRS accepts your offer, you’ll need to abide by the terms you agreed to and stay current with filing and paying your taxes for five years after that.

Moreover, you’re not going to jail. If you owe less than $50,000 in tax, interest and penalties combined, you can set up a plan that allows you to pay down over time, with regular monthly payments. There is a penalty for failure to file a return, as well as interest and penalties on the amount due if not paid.

I can't pay my taxes Alert:. The failure-to-file penalty is a steep 5% per month (up to a maximum of 25%) on the outstanding amount. If you are a wage earner with a salary of $50,000 with no withholdings, you could end up owing close to.

If you send your tax return on time, you will avoid paying extra for filing late. Even the IRS understands life happens. It's very important that you file a properly prepared tax return, even if you can't pay the full liability.

There are some things you can do to remedy the situation and avoid landing in hot water with the IRS. Your balance will still accrue interest if you do this, but you'll avoid the failure-to-pay penalty. You can make a partial payment with TurboTax.

If monthly payments toward your tax debt will make you unable to afford basic living expenses, you may be able to apply for an Offer in Compromise. The new tax law has led to an increase in Americans owing money as well as receiving lower-than-expected refunds. For example, if you make $50,000 in self-employment income, and fail to make estimated tax payments during the year, you could end up owing $10,000 or more at the end of the year.

Even if you can’t pay the amount due in full, be sure to file your tax return. If you pay some now, the penalty will be smaller later. En español | If you can’t pay all the tax money you owe the federal government this year, the Internal Revenue Service has some options for paying over time.

The IRS currently charges a monthly fee equal to 0.5% of your unpaid tax balance, up to a maximum of 25%, if you do not pay by the deadline. If they can’t pay it all, they have some other options. Instead, as IRS Commissioner Charles Rettig confirmed in a letter to Congress recently, the agency literally can't afford to audit the rich, so it's pursuing the poor instead.

The key is to not avoid the problem. Under certain circumstances, taxpayers can have their tax debt partially forgiven. I can't afford to pay my tax debt.

You have several options available if your ability to pay has changed and you are unable to make payments on your installment agreement or your offer in compromise agreement with the IRS. Consider a Payment Plan. This will help reduce penalties and interest.

"It is far better to file an extension or file a tax return, even if you owe money and can't afford to. The IRS will work with you to reach a fair solution, either through an installment agreement, an offer in compromise, or an offer to delay collection until you are financially able to repay back taxes. When the IRS considers forgiving your tax liability, they look at your present financial condition first.

If you are unable to pay your federal income taxes, be honest with the IRS agent handling your case and explain the reasons why you cannot afford to pay. This installment agreement request – once approved --. You must pay any taxes owed.

That’s a fairly small price for a bit of extra time. So, if you owe the IRS $2,000, you’d pay the payment processor about $40 to use your credit card. Many states have resolution frameworks for taxpayers in need.

Debt forgiveness, insolvency and job loss can affect your taxes. You'll still owe taxes on July 15. Cannot Afford Property Taxes.

If you can afford to pay some, send it by July 15. For the 18 tax year, the penalty for filing late is 5% of your taxes owed for each month your return is late, up to a maximum of 25%. If you realize that you cannot feasibly pay back the total tax owed to the government, you may choose to pursue an Offer in Compromise.

The rules of replying:. Pay some of the tax you owe. If the IRS accepts your offer.

This is a space for friendly local discussions. However, the IRS is willing to work with most taxpayers who can’t pay taxes in full. The late payment penalty, by comparison, is just 0.5% of the unpaid taxes due.

If you can’t afford to pay your taxes, the IRS has several options to help you pay without landing you in hot water or charging excessive fees. I Can't Afford My Taxes!. The IRS will generally accept any installment agreement you propose if you owe less than $50,000 and can pay in six years or less.

We all know (or should know!) when our tax is due for payment, or any big bill actually, but it’s so easy to be left short, and not have enough to pay. Your best bet is to seek professional advice from a tax professional who's authorized to represent you before the IRS if you can't afford to make any payment toward your taxes at all. The realization that you can’t afford to pay your taxes can make you feel uneasy, but don’t worry.

One for filing late and one for failing to pay. If you can't pay your tax bill in full on time, you'll still garner a much lower penalty than you would by waiting to file your return. The IRS offers options when you can’t afford to pay a tax bill.

Currently not collectible status:. So if you simply don’t have the money, try one of these options:. To protect the public and employees, and in compliance with orders of local health authorities around the country, certain IRS services such as live assistance on telephones, processing paper tax returns and responding to correspondence are extremely limited or suspended until further notice.

These can be extremely difficult to qualify, and it’s important to use the help of a tax expert to. Pay by credit card As an alternative to paying by check, the IRS (and many states) will gladly accept payment by credit card. That will just worsen the problem.

If you don't cooperate with the IRS, you can expect. To appeal a rejection, use IRS Form , Request for Appeal of Offer in Compromise. If you cannot pay because of coronavirus (COVID-19) Because of coronavirus you may be able to delay (defer) your Self Assessment payment on account due in July until 31 January 21.

Pay Using Installment Plans. If you can pay it then, do so.If you can't, send as much as possible (again, reducing penalties and interest) and hang on. But now you’re looking at a tax bill that you just can’t afford to pay.

The most important advice we can offer folks who can’t afford to pay taxes by the April deadline is this:. Don’t avoid the problem!. This typically includes CPAs, attorneys, and enrolled agents.

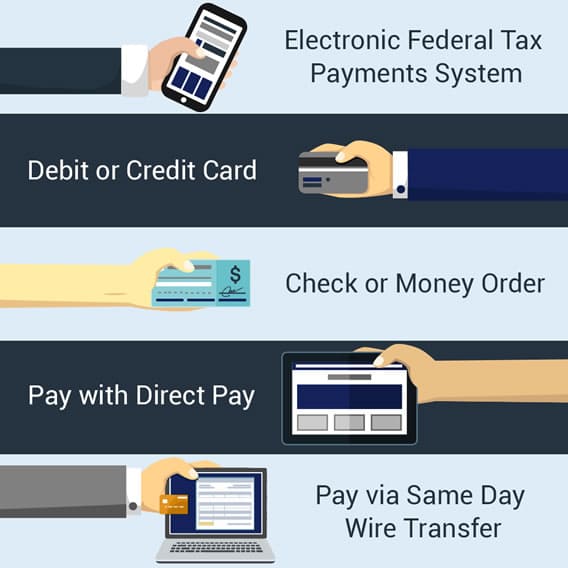

Options for Paying Now. According to the Internal Revenue Service (IRS), those who can’t afford to pay their full tax bill up front have three options:. When You Can't Pay Your Taxes at All.

If you can’t pay off that bill in full when it shows up on your credit card payment,. The lender may also pay the back due property taxes in advance and work out a payment plan through mortgage escrow;. Most important, however, is that you file your return by the April 15 deadline.

Most importantly, if you believe you may have trouble paying your tax bill, contact the IRS immediately. The good news is there are many ways to prevent this from happening the next time you file. Enrolling in a payment plan, settling the debt for less or requesting.

This is a settlement with the IRS to pay less than you owe. Call the IRS immediately at 1-800-9-1040. The agency may be able to provide some relief such as a short-term extension to pay, an installment agreement or an offer in compromise, or by temporarily delaying collection by reporting your account as currently not collectible until you are able to pay.

When you file your taxes, don’t pay online at that time if you can’t afford it in cash. The best option is to avoid using a credit card to pay your debt, which would ordinarily be many consumers’ first choice. If you don't pay, you'll get a 0.5% penalty by the IRS.

Once you and the IRS enter into an installment agreement, you have to stay current on future taxes. The Internal Revenue Service reminds taxpayers who can’t pay the full amount of federal taxes they owe that they should file their tax return on time and pay as much as possible. You have to pay your tax by 31 January, but you can’t afford to pay it.

What You Shouldn T Do If You Owe The Irs Smartasset

5 Steps To Take If You Owe Taxes And Can T Pay

Can I Apply For Naturalization If I Owe Back Taxes Maybe

Tax Debt Call The Irs As Your First Step The Washington Post

What To Do If You Can T Afford To Pay Your Taxes

What If I Can T Afford To Pay My Taxes

Coronavirus Irs Tax Payment Is It Possible To Get An Extension Until 15 October As Com

What To Do If You Owe The Irs But You Can T Pay Personal Finance Us News

If You Can T Afford Life S Necessities You Can T Afford To Pay Taxes

How Much Do I Owe The Irs 4 Ways To Pay Off Your Irs Tax Bill

Episode 31 Negotiating Tax Payments With The Irs Richardson Law Offices

With July 15 Deadline Approaching 37 Of Taxpayers Can T Pay Because Of Covid Cpa Practice Advisor

Learn How To Settle Your Irs Back Taxes Jg Tax Group

3 Tax Mistakes You Can T Afford To Make The Motley Fool

What To Do If You Can T Afford To Pay Taxes You Owe The Irs On July 15 News Break

What If I Can T Afford To Pay My Taxes

/9465-InstallmentAgreementRequest-1-ad4522a907c94ba7a959e9bc7549e14d.png)

Form 9465 The Irs S Monthly Payment Plan

Can T Pay Taxes 7 Realistic Options If You Are Unable To Pay Irs Taxes

What Happens If You Don T File Taxes Or Pay Your Bill By Tax Day Business Insider

Coronavirus Stimulus Checks New Irs Tool Tracks Your Payment

Remember How The Irs 1040 Form Was Going To Be On A Postcard Here S Why It Didn T Happen

If You Have Tax Debt Here Are 5 Tips To Set Things Right With The Irs

You Owe Money To The Irs But You Can T Pay Your Tax Bill Here Are Your Options Nj Com

What If You Owe Taxes But Can T Pay Your Tax Bill Investorplace

Fbar Fatca Penalties Irs Amnesty For When You Can T Afford To Pay Youtube

How Much Do I Owe The Irs How To Find Out If You Owe Back Taxes

Five Signs That You Need Back Taxes Help Now Tax Defense Network

What If You Can T Afford To Pay Your Taxes Applying For An Extension Is An Option Chicago Tribune

What Is Currently Not Collectible Status From The Irs

Here S What To Do If You Can T Pay Your Taxes

Tax Extension Form 4868 E File By April 15 21

Irs Payment Plans Installments Ways To Pay E File Com

Can I Pay Installments On Federal Income Taxes I Owe If I Can T Afford To Pay It All At Once The Tax Debt Solution

Taxpayer Advocate Service I Can T Pay My Taxes

What Is The Irs Debt Forgiveness Program Tax Defense Network

What To Do If You Can T Pay Your Taxes

What Happens After A Missed Payment On An Irs Installment Agreement

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/6FDBC4H5ERFDRBYQDWLDCDSZIQ.jpg)

Don T Want To File Your Taxes Get Ready To Pay A Lot

Can T Afford To Pay The Irs Here S How To Solve Your Problem Debt Relief Programs Debt Relief Companies Tax Debt

2

Irs Tax Evasion Fraud Definition Penalties What If You Don T Pay

/9465-InstallmentAgreementRequest-1-ad4522a907c94ba7a959e9bc7549e14d.png)

Form 9465 The Irs S Monthly Payment Plan

Will The Government Shutdown Delay My Tax Refund Kiplinger

Can T Afford Your Irs Tax Bill Here Are Your Options Identityiq

What To Do If You Owe The Irs And Can T Afford To Pay Cecra

What To Do If You Can T Afford To Pay Taxes You Owe The Irs On July 15

Here S What You Need To Know About Filing A Tax Extension In 18

Tax Time What To Do If You Can T Afford To Pay The Irs Csmonitor Com

Can T Afford To Pay The Irs Here S How To Solve Your Problem

What To Do If You Can T Pay Your Taxes Taxes Us News

What If You Can T Afford To Pay The Taxes You Owe Tax Problem Solver

How To Set Up An Irs Tax Payment Plan 8 Steps To Consider

What If You Can T Pay The Irs Blog Life In The Taxlane

Glitches Still Plaguing Stimulus Payments The Washington Post

2

What Is A Tax Lien And How Does It Affect Your Business

Can You Afford To Pay The Irs Money This Tax Season 44 Of Americans Can T The Motley Fool

Surprise No Tax Refund For You What Not To Do If You Owe The Irs The Washington Post

Paying Back Taxes How To Pay Back Taxes To The Irs

What Happens After A Missed Payment On An Irs Installment Agreement

Irs Extends Tax Payment Deadline 90 Days

1040 Com Can T Afford To Pay Your Taxes By July 15 There S Hope Especially During The Coronavirus Pandemic See How The Irs Is Helping Taxpayers Manage Taxes Owed And Debt T Co Zt1zr4kcyd

Can T Pay Taxes

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

What To Do If You Can T Pay Your Tax Bill Cnet

Tax Cheats Rejoice The Irs Can T Afford To Track You Down The Fiscal Times

Irs Stimulus Payment Recipients Lash Out Against Trump S Vanity Letter The Washington Post

Irs Payment Plan Options For Your Tax Bill Bankrate Com

What Do I Do If I Can T Afford To Pay My Taxes Daveramsey Com

What To Do If You Owe Taxes And Can T Afford To Pay Them Bankrate Com

What Is The Law On Unfiled Tax Return Forgiveness Amnesty

Ntmgyfylhb16gm

Taxes Are Due What Happens If You Can T Pay The Irs By Westwing Issuu

What To Do If You Can T Afford To Pay Taxes You Owe The Irs On July 15

Tax Time What To Do If You Can T Afford To Pay The Irs Cwseapa

What Is The Minimum Monthly Payment For An Irs Installment Plan Turbotax Tax Tips Videos

The Irs Is Now Only Targeting Poor People For Audits Since They Can T Afford To Hire Lawyers Poor People Audit Irs

When You Owe But Have No Dough Your Guide To Dealing With Taxes You Can T Afford To Pay Credit Sesame

What To Do If You Owe The Irs And Can T Pay

Irs Installment Agreement Setting Up A Tax Payment Plan Debt Com

What To Do If You Can T Pay Your Taxes

3 Irs Payment Plan Options When You Can T Afford Your Tax Bill Youtube

Tax Bill What To Do If You Owe The Irs

Help I Can T Pay My Taxes Virginia Beach Tax Preparation

What If I Can T Pay My Taxes What To Know

Stand Up To The Irs Tax Law Legal Book Nolo

Here S What To Do If You Can T Pay Your Taxes

/GettyImages-505872588-5bca34b346e0fb0051748309.jpg)

Installment Agreements With The Irs

Get My Payment Irs Portal For Stimulus Check Direct Deposit Money

The Procrastinator S Guide To Filing Quarterly Taxes Cashville Skyline

After Tax Day What S Next Top 10 List Independent Investment Advisors

Can I Still File Taxes If I Owe The Irs A Guide

I Can T Afford Irs Payment Plan What Should I Do

Can The Irs Garnish My Stimulus Check If I Owe Back Taxes Money