Cant Afford To Pay Taxes

Opinion The Tax Europe Can T Afford Not To Pay The New York Times

Here S What You Need To Know About Filing A Tax Extension In 18

What Happens If You Owe Taxes And Can T Pay Them Lha

People Try To Live Within Their Income So They Can Afford To Pay Taxes To A Government That Can T Live Within Its Income In Investing Books Tax Haven Paying Taxes

What To Do If You Can T Afford To Pay Taxes You Owe The Irs On July 15 News Break

Oh You Pay For It In Your Taxes In A Further Comment They Said That Charities Are For When You Can T Afford Healthvare Nor Insurance Shitamericanssay

If you owe more in taxes than you can afford to pay, you have better options than simply not paying.

Cant afford to pay taxes. If you can’t afford to pay your taxes, the IRS has several options to help you pay without landing you in hot water or charging excessive fees. Paying with a credit card As you probably know, you can pay your tax bill with Visa. You can go on the IRS website and apply for a payment plan.

Generally, 0.5% of your unpaid taxes for every month you fail. Even if you can’t pay the amount due in full, be sure to file your tax return. That’s a fairly small price for a bit of extra time.

Local governments levy property taxes to raise funds for essential community services. The penalty for not paying your taxes depends on the total tax you owe. Here's what you need to know if you haven't yet completed your 19 return.

If you can’t pay off that bill in full when it shows up on your credit card payment,. You also should contact the IRS to discuss your payment options at 800-9-1040. For those homeowners who use all their income to pay basic living expenses, such as mortgage installments, heating and food, property taxes can be a struggle.

Plus, if you can show cause for your late payment, the charges could be waived. The IRS understands there may be times when you can’t pay a tax debt due to your current financial situation. For example, if you make $50,000 in self-employment income, and fail to make estimated tax payments during the year, you could end up owing $10,000 or more at the end of the year.

As you may know, as a self-employed individual you are obligated under the law to pay federal income tax, along with Medicare and Social Security taxes, more commonly called self-employment tax. If you cannot pay your individual tax debt in full now, you may qualify for a payment arrangement or ask for taxpayer relief. The failure-to-file penalty is a steep 5% per month (up to a maximum of 25%) on the outstanding amount.

We all know (or should know!) when our tax is due for payment, or any big bill actually, but it’s so easy to be left short, and not have enough to pay. When you file your taxes, don’t pay online at that time if you can’t afford it in cash. See Innocent spouse (relief from joint tax liability).

They will work with you to plan how to pay the rest of your tax. You can get a good idea of your tax liability (for free) by using Turbo Tax or other online software, since you only pay when you file. Don’t avoid the problem!.

If you pay some now, the penalty will be smaller later. If your monthly expenses are more than your monthly income and you cannot afford a. If you're struggling to pay the property taxes on your home, you could be at risk of losing the property to foreclosure or a tax sale.

Check to see what neighbors are paying for property taxes or check to see what similar properties are being taxed for within a one square mile radius. You are supposed to pay the money owed for income taxes at the time you file your taxes. Apr 6, 06 at 12:00AM.

You'll still owe penalties and interest for paying your taxes late, but it can help make the payments more affordable. If you can't pay the amount you owe in full, you may qualify for:. Challenging Your Home’s Assessed Valuation.

However, the IRS is willing to work with most taxpayers who can’t pay taxes in full. If you can't pay your tax bill in full on time, you'll still garner a much lower penalty than you would by waiting to file your return. Once you and the IRS enter into an installment agreement, you have to stay current on future taxes.

But you might be able to either reduce the amount of property tax that you have to pay or buy yourself some extra time to get caught up on what you owe. Homeowners can also see if they can do a property tax appeal. Under this plan, rather than pay the property tax in full all at once, you simply pay half of the amount twice before the due date.

Filing Your Return-> Can't Pay the Tax Owed What If I Can't Afford to Pay the Tax I Owe?. If the IRS agrees that you can’t pay your taxes and pay your reasonable living expenses, it may place your account in a status called Currently Not Collectible. The IRS currently charges a monthly fee equal to 0.5% of your unpaid tax balance, up to a maximum of 25%, if you do not pay by the deadline.

Taxpayers commonly use an OIC when they have few or no assets and have trouble paying their necessary living expenses. This will clear your tax debt without you having to come up with the entire balance right away. This lets you pay your Self Assessment.

The key is to not avoid the problem. If you don't pay, you'll get a 0.5% penalty by the IRS. Most states charge you a late payment penalty, and all of them charge interest on the debt.

Roy Lewis (TMFTaxes) Updated:. If you cannot pay the full amount of taxes you owe, you should still file your return by the deadline and pay as much as you can to avoid penalties and interest. An installment payment agreement.

How much you pay in federal taxes is based on your adjusted gross income. Be sure that you file your tax return on time even if you cannot afford to pay $1 of your tax liability. But even if you can’t pay a tax bill on time, don’t neglect to file your return by the deadline.

You'll still owe taxes on July 15. Despite the fact that you can’t afford to pay your tax, you need to finish filing and send the returns by the deadline. You can’t solve it by not filing or by hiding from the IRS.

To qualify for many of these options, you must apply and meet specific criteria. If you can’t afford to pay your taxes, you may be able to qualify for an installment plan with the Internal Revenue Service. There are steps Canadian can take if they can't afford to pay their tax balance in full.

Cannot Afford Property Taxes. I Can't Afford My Taxes!. The IRS will work with you to reach a fair solution, either through an installment agreement, an offer in compromise, or an offer to delay collection until you are financially able to repay back taxes.

If you can't afford to pay them you have a problem. Pay Using Installment Plans. If you own a home in the United States, you are assessed for property tax.

The application process and eligibility criteria for an abatement vary by area, and you might have to document your income and assets to prove that you can't afford to pay the taxes. Enrolling in a payment plan, settling the debt for less or requesting. In addition, it the loan is defaulted while you are still employed then the loan will be paid off from the 401(k) funds which then becomes a taxable distribution taxed at your margional tax rate plus a 10% penalty if you are under age 59 1/2.

You can make a partial payment with TurboTax. It’s that dreaded time of year again. So, if you owe the IRS $2,000, you’d pay the payment processor about $40 to use your credit card.

If you can’t make any sort of payment now. Look Into a. What do you do?.

You must pay any taxes owed. The IRS assesses two types of tax penalties:. If you are unable to pay your federal income taxes, be honest with the IRS agent handling your case and explain the reasons why you cannot afford to pay.

An installment payment plan is one option if you can't pay the full amount of your property tax. Taxes Taxes Credits & Deductions Forms Tax Filing Deadlines & Extensions Promotions Tax Planning Tax Refunds Tax Reform State Taxes. The best option is to avoid using a credit card to pay your debt, which would ordinarily be many consumers’ first choice.

If you cannot pay your Self Assessment tax bill for other reasons If you owe less than £10,000 you might be able to set up a Time to Pay Arrangement online. For the 18 tax year, the penalty for filing late is 5% of your taxes owed for each month your return is late, up to a maximum of 25%. For example, if you are still paying off your 16 tax bill, forget about an installment deal for 18.

If you choose to pay with your bank account or credit card, TurboTax will charge the total tax due. Other exceptions the CRA may grant you if you can show you really can’t pay. "It is far better to file an extension or file a tax return, even if you owe money and can't afford to.

And what happens if you can’t afford to pay your taxes?. An installment plan allows you to pay your taxes over time while avoiding garnishments, levies or other collection actions.;. An offer in compromise if you are severely financially distressed.

Even if you can't afford to pay the income tax that you owe, you should file your tax return by the annual deadline in order to avoid any late-filing penalties.Then, contact Canada Revenue Agency (CRA) regarding payment (see link below). Various state-wide programs that were available in. He says if you owe money, but you can’t afford to pay by July 15 – don’t panic.

You have to pay your tax by 31 January, but you can’t afford to pay it. The most important advice we can offer folks who can’t afford to pay taxes by the April deadline is this:. There's also a penalty for failure to file a tax return, so you should file timely even if you can't pay your balance in full.

One for filing late and one for failing to pay. If you are a wage earner with a salary of $50,000 with no withholdings, you could end up owing close to. The realization that you can’t afford to pay your taxes can make you feel uneasy, but don’t worry.

Many states have resolution frameworks for taxpayers in need. If you cannot afford to pay your property tax installments, there are only a few options for assistance in California. Face the issue head on so you can get the mess cleaned up, then make sure you’re never in that position again.

If you submit your T1 tax. There is a penalty for failure to file a return, as well as interest and penalties on the amount due if not paid. What are ramifications of default on 401K loan, can’t afford to pay?.

This installment agreement request – once approved --. 8 Tax-Filing Mistakes You Can't Afford to Make This Year This year looks a little different from a tax perspective. Offer in compromise (OIC):.

There are some things you can do to remedy the situation and avoid landing in hot water with the IRS. Tax payment is in some ways divorced from tax return filing. The late payment penalty, by comparison, is just 0.5% of the unpaid taxes due.

You cannot pay your individual tax debt in full now. The IRS offers options when you can’t afford to pay a tax bill. The government is sensitive to the issue of whether you can afford to pay, so they’re willing to work with you a little bit.

Feb 15, 17 at 11:44AM Published:. That is, you can’t pay 18's taxes via installment and then request to pay 19's taxes via. So, if you can’t pay your taxes,you might not have to pay until you’re able to.

The current rate for self-employment tax is 15.3% on the first $106,800 you earn. In comparison, if you file your taxes and do not pay, the IRS will charge you with a failure-to-pay penalty, which is much less harsh:. To help people who cannot afford to pay their taxes, the IRS and many states offer different resolution options.

According to the Internal Revenue Service (IRS), those who can’t afford to pay their full tax bill up front have three options:. This is because the IRS has two types of tax penalties- one for filing your returns late and one for failing to pay your taxes- and you don’t want to face both penalties. This is a settlement of your unpaid taxes for less than the amount you owe – if you qualify.

In the File section, select I will mail a check. Contact the IRS as soon as you know you can’t pay, before the deadline if possible. There are several ways you can handle the situation, and you get the best chance for a deal if you initiate it.

There are ways to solve things and make things right. Relief from a spouse's debt. Lack the cash to pay the IRS?.

Find out what you should do if you can't afford to pay your federal income tax bill this year from our very own tax guru, Mark. Jump to navigation links Jump to main content Jump to footer links. The IRS, the agency responsible for collecting taxes, literally can't afford to audit the people with the most to hide.

A payment arrangement is an agreement you make with the CRA. If you're not able to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty. This could be because they have a tax liability and due to a drastic change in their financial or personal circumstances over the year, they cannot afford to file their taxes.

Apply for help if you can't pay in full.

What To Do If You Can T Afford To Pay The Taxes You Owe

When You Owe But Have No Dough Your Guide To Dealing With Taxes You Can T Afford To Pay Credit Sesame

What To Do If You Can T Pay Your Taxes Taxes Us News

Tax Law North Fulton Bar

3 Tax Mistakes You Can T Afford To Make During The Covid 19 Crisis The Motley Fool

What If You Want To File Your Taxes But Can T Afford To Pay Them Guardian Tax Solutions Inc

Taxpayer Advocate Service I Can T Pay My Taxes

What To Do When You Can T Afford Your Taxes Kiowa County Press Eads Colorado News And Information

The Blog Tip You Can T Afford To Miss How Do Self Employment Taxes Work If You Don T Make A Profit Do Blogger Earn Money Blogging Blog Tips Money Blogging

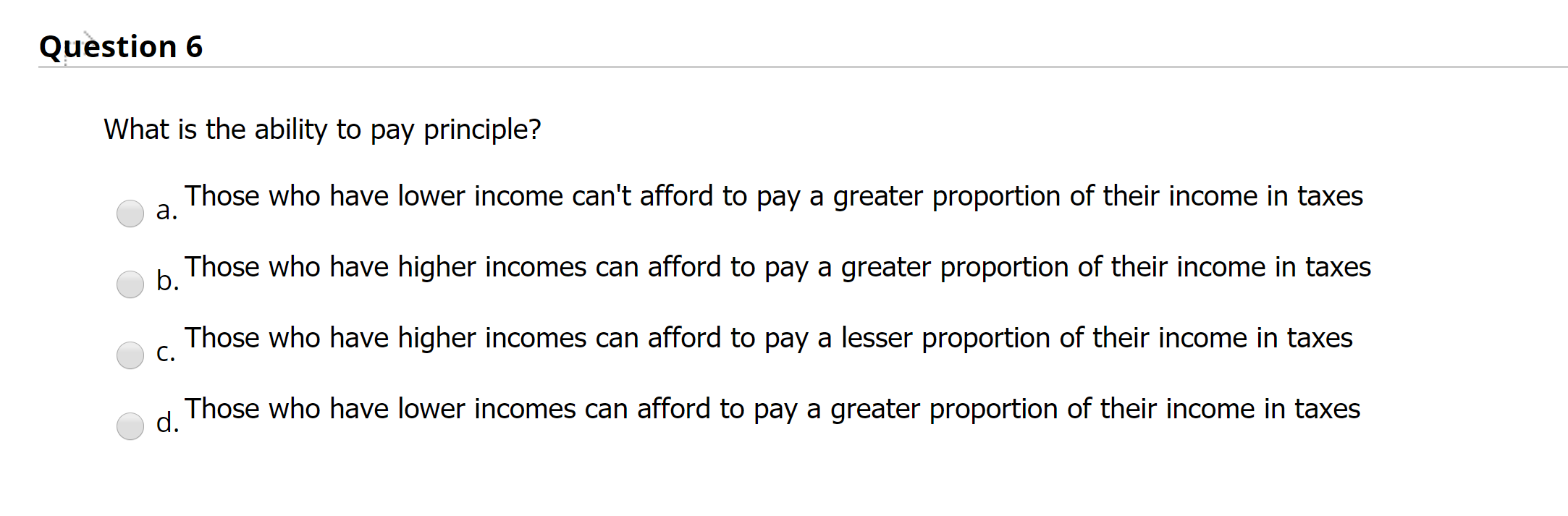

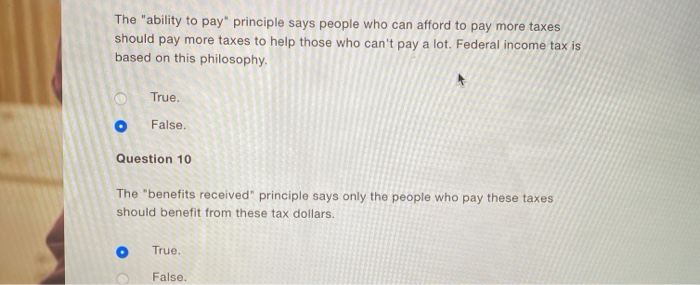

Solved Question 6 What Is The Ability To Pay Principle T Chegg Com

Commentary What To Do If You Owe Taxes And Can T Afford To Pay Them

What To Do If You Can T Afford To Pay Taxes You Owe The Irs On July 15

Stop Paying Taxes Dankmemes

8 Small Business Tax Deductions That You Can T Afford Not To Take Advantage Of Due

What If You Owe Taxes But Can T Pay Your Tax Bill Investorplace

Sticker Shock I Got My Tax Bill But I Can T Afford To Pay It

How To Pay A Tax Bill You Can T Afford Consumerism Commentary

What If You Want To File Your Taxes But Can T Afford To Pay Them Coastal Tax Advisors

What If You Owe Income Taxes And Can T Afford To Pay Fivecentnickel Com

Five Reasons To Pay For Tax Reform Committee For A Responsible Federal Budget

But I Can T Afford To Pay To File My Taxes

What If You Can T Afford To Pay Your Taxes Applying For An Extension Is An Option Chicago Tribune

Wny Residents Just Can T Afford To Pay More State Taxes Ny State Senate

What If You Want To File Your Taxes But Can T Afford To Pay Them 10 Key Solutions

Kuow Tax Amazon Say Small Business Owners We Can T Afford To Pay More

What If I Can T Pay My Taxes Don T Panic Here S What To Do Filetaxes Online Blog

I Can T Afford Irs Payment Plan What Should I Do

Solved The Ability To Pay Principle Says People Who Can Chegg Com

Can T Afford To Pay Your Tax Bill Here S What You Can Do Globalnews Ca

5 Options For Paying Your Tax Debt When You Can T Afford It Navicore Navicore

Cpa S Advice For Self Employed Workers With Multiple Tax Bills Business Insider

Jack Knox Trapped By A Tax He Can T Afford To Pay Or Fight Times Colonist

3 Retirement Tax Mistakes You Can T Afford To Make

What To Do If You Can T Afford To Pay Taxes You Owe The Irs On July 15

Your Complete Action Plan If You Know You Can T Afford To Pay Your Taxes Silver Tax Group

If We All Stopped Paying Taxes The Gov Can T Afford To Stop Us M Dunk The Future Is Now Old Man Let S Go Gamers Dunk Meme On Me Me

Can T Afford Your Tax Burden Here S What To Do

Can T Afford Your Irs Tax Bill Here Are Your Options Identityiq

Options When You Can T Afford To Pay Your Taxes Dealing With Back Taxes

What To Do If You Can T Afford To Pay Your Taxes

I Can T Afford To Pay My Tax Debt Gwinnett Ga Patch

If You Can T Afford Life S Necessities You Can T Afford To Pay Taxes

What If I Can T Afford To Pay My Taxes Owings Mills Md Patch

How To Resist National War Tax Resistance Coordinating Committee

What To Do When You Get Medical Bills You Can T Afford

Can T Afford To Do Anything About Estate Tax Stacey Romberg

What If I Can T Afford To Pay My Taxes Tl Dr Accounting

What Do I Do If I Can T Afford My Taxes This Year Taxact Blog

5 Tips For People Who Don T Have The Money To Pay Their Tax Bill Investmentnews

What If I Can T Pay My Taxes What To Know

What If You Want To File Your Taxes But Can T Afford To Pay Them Joseph L Stefanski Cpa Pa

I Can T Afford To Pay Taxes That Provide Better Education Politicalhumor

5 Ways To Pay A Tax Bill You Can T Afford

Lowtax Global Tax Business Portal Tax Cartoons

Can T Afford To Pay Your Tax Bill We Can Help New York Tax Attorney Blog

Paying Back Taxes How To Pay Back Taxes To The Irs

What To Do If You Can T Pay Your Taxes Notre Dame Fcu

What To Do If You Can T Afford To Pay Your Taxes Financial Freedom Now

Tax Time What To Do If You Can T Afford To Pay The Irs Cwseapa

How Long Can I Go Without Paying Taxes What If I Can T Aff

Last Year 91 Corporations Paid Nothing In Federal Income Taxes When Politicians Tell You We Can T Afford Education Health Care Childcare Or Clean Water They Re Lying Sandersforpresident

8 Tax Filing Mistakes You Can T Afford To Make This Year Smart Change Personal Finance Dailyjournalonline Com

Small Business Tax Preparation Mistakes Your Company Can T Afford

I Can T Afford To Pay Taxes Confession Ecard

What Do I Do If I Can T Afford To Pay My Taxes Daveramsey Com

Here S What To Do If You Can T Pay Your Taxes

Six Options If You Cannot Afford To Pay Your Taxes

What If I Can T Afford To Pay My Taxes

What Do I Do If I Can T Afford My Taxes This Year Taxact Blog

Expert Says Those Who Can T Afford To Pay Taxes Should Still File Cbs Denver

Cant Afford Tax Bills What Can And What Should You Do Black Ink

How To Negotiate A Medical Bill You Can T Afford To Pay

What To Do If You Owe Taxes And Can T Afford To Pay Them Bankrate Com

What If You Can T Afford To Pay The Taxes You Owe Tax Problem Solver

Tax Day Is July 15 Deductions You Can T Afford To Forget On Your 19 Federal Income Tax Return News Break

Can T Afford Your Tax Bill This Year Here Are Some Options

Robert Half Government Quotes Quotehd

What Happens If You Don T File Taxes Or Pay Your Bill By Tax Day Business Insider

Here S What To Do If You Can T Afford To Pay Your 16 Taxes

What To Do If You Can T Pay Your Taxes By Your Tax Bill Deadline

You Owe Money To The Irs But You Can T Pay Your Tax Bill Here Are Your Options Nj Com

What Happens If You Don T File Your Taxes Taxact Blog

What If I Can T Pay My Tax Bill 6 Tips For Filers Who Owe Too Much Aol Finance

Taxes We Can T Afford The Rich

Can T Pay Your Tax Bill Here Are Your Tax Preparation Options Ferguson Timar Co Finance Accounting Services

When You Owe But Have No Dough Your Guide To Dealing With Taxes You Can T Afford To Pay Credit Sesame

Can T Pay Taxes 7 Realistic Options If You Are Unable To Pay Irs Taxes

9 Of The Biggest Tax Myths You Should Never Fall For Cnet

Can T Pay Taxes

Tax Time What To Do If You Can T Afford To Pay The Irs Csmonitor Com

What To Do If You Owe Taxes Can T Afford To Pay Them News Nny360 Com

How Much Do I Owe The Irs 4 Ways To Pay Off Your Irs Tax Bill

Finance Xpress What To Do If You Can T Pay Your Taxes

If No One Paid Taxes The Government Can T Afford To Stop Us Pewdiepiesubmissions